I did a post on decision-making years ago (here) but I wanted to share some more on it. As financial advisors, our “product” is really wisdom (as I’ve said before), and it turns out we are wiser about other people’s situations than we are our own. This has two implications, 1) our clients (even our very wise clients) need us, and 2) we need wise advisors ourselves (or strategies to get distance on our issues) no matter how wise we consider ourselves to be. (I’m blessed to have Anitha.) From Aeon:

… When inspecting the results, scholars observed a peculiar pattern: for most characteristics, there was more variability within the same person over time than there was between people. In short, wisdom was highly variable from one situation to the next. The variability also followed systematic rules. It heightened when participants focused on close others and work colleagues, compared with cases when participants focused solely on themselves.

These studies reveal a certain irony: in those situations where we might care the most about behaving wisely, we’re least likely to do so. Is there a way to use evidence-based insights to counter this tendency?

My team addressed this by altering the way we approach situations in which wisdom is heightened or suppressed. When a situation concerns you personally, you can imagine being a distant self. For instance, you can use third-person language (‘What does she/he think?’ instead of ‘What do I think?’), or mentally put some temporal space between yourself and the situation (how would I respond ‘a year from now’?). Studies show that such distancing strategies help people reflect on a range of social challenges in a wiser fashion. In fact, initial studies suggest that writing a daily diary in a distant-self mode not only boosts wisdom in the short term but can also lead to gains in wisdom over time. The holy grail of wisdom training appears one step closer today.

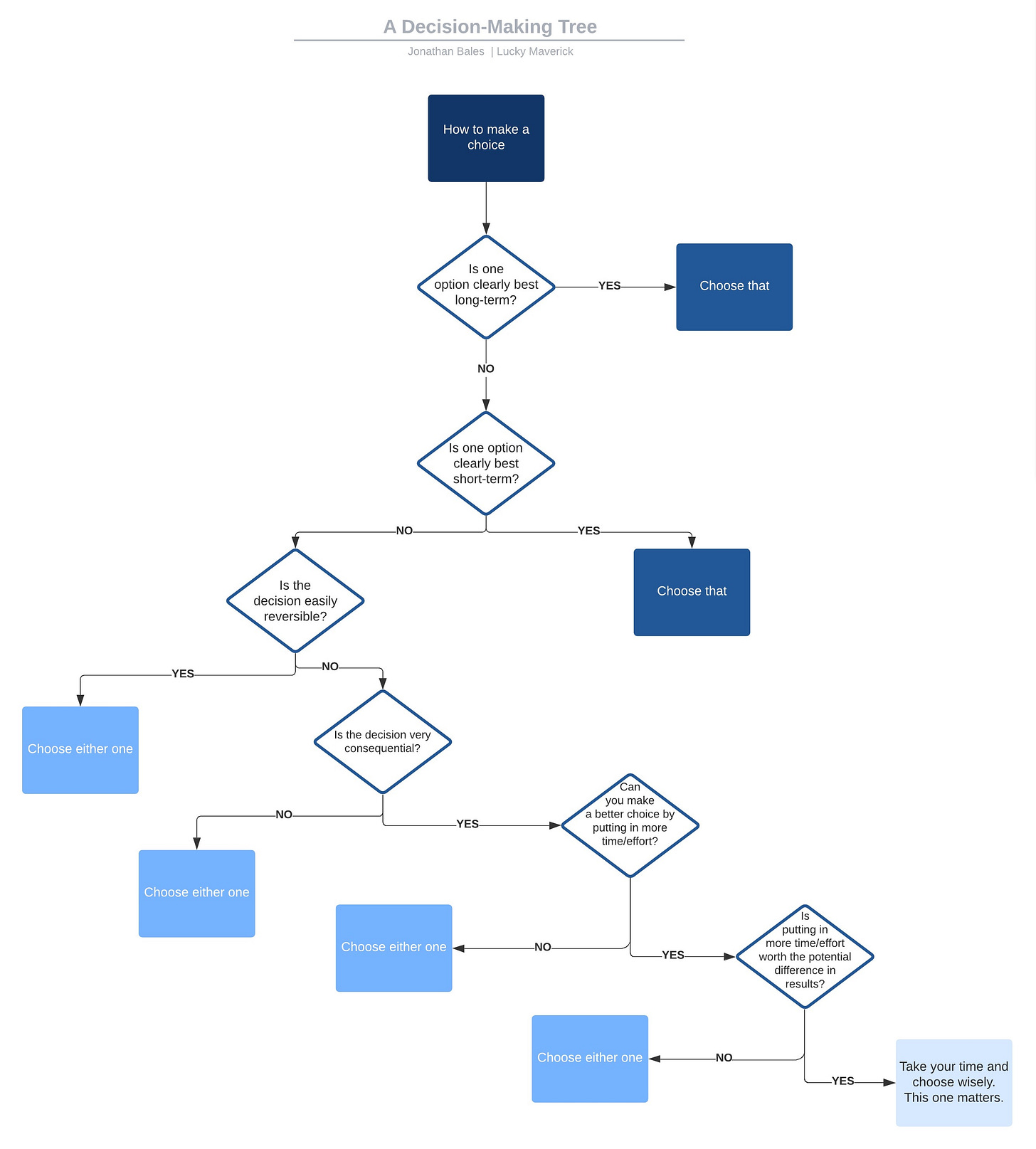

Related, here’s an excellent decision-making flowchart:

Also, you may be able to get the wisdom of crowds … without the crowd, as shown in this paper. Here’s the abstract:

Many decisions rest upon people’s ability to make estimates of some unknown quantities. In these judgments, the aggregate estimate of the group is often more accurate than most individual estimates. Remarkably, similar principles apply when aggregating multiple estimates made by the same person – a phenomenon known as the “wisdom of the inner crowd”. The potential contained in such an intervention is enormous and a key challenge is to identify strategies that improve the accuracy of people’s aggregate estimates. Here, we propose the following strategy: combine people’s first estimate with their second estimate made from the perspective of a person they often disagree with. In five pre-registered experiments (total N = 6425, with more than 53,000 estimates), we find that such a strategy produces highly accurate inner crowds (as compared to when people simply make a second guess, or when a second estimate is made from the perspective of someone they often agree with). In explaining its accuracy, we find that taking a disagreeing perspective prompts people to consider and adopt second estimates they normally would not consider as viable option, resulting in first- and second estimates that are highly diverse (and by extension more accurate when aggregated). However, this strategy backfires in situations where second estimates are likely to be made in the wrong direction. Our results suggest that disagreement, often highlighted for its negative impact, can be a powerful tool in producing accurate judgments.

Finally, from Annie Duke:

Investing is hard, because you need to answer these questions:

- Am I being disciplined or stubborn?

- Am I being foolish or staying ahead of the curve?

- How useful is market history?

- What if it really is different this time?

- Do I have enough?

See also:

- The Times that Try Stock-Pickers’ Souls

- How Much Conviction Do You Hold in Your Investment Views?

- Even Great Investments Experience Massive Drawdowns

- Negativity Is Not an Investment Strategy

As Voltaire observed, “Doubt is an uncomfortable condition, but certainty is a ridiculous one.”